Vespa Capital achieves top decile performance in Private Equity module in 2023 UN PRI Reporting

- Vespa Capital ›

- Vespa Capital News Blog ›

- Unpri 2023 Reporting

Vespa Capital is pleased to share the Summary Scorecard as well as Public Transparency and Assessment Reports as part of the UN Principles for Responsible Investment (UNPRI) 2023 annual reporting process.

Following a reorganisation of the UNPRI Reporting Framework, the updated PRI scoring methodology places stronger focus on responsible investment (RI) implementation across overall investment processes and AUM coverage. Furthermore, the framework considers the sophistication of RI practices, consistency of approach, as well as clarity on the timeframe of implementation.

As a signatory of the UNPRI, Vespa Capital is committed to ongoing transparency and accountability regarding our ESG approach. Reporting on responsible investment activities through the PRI’s Reporting Framework further demonstrates Vespa Capital’s obligation to promoting long term sustainable growth and identifying how we can improve ESG investment practices.

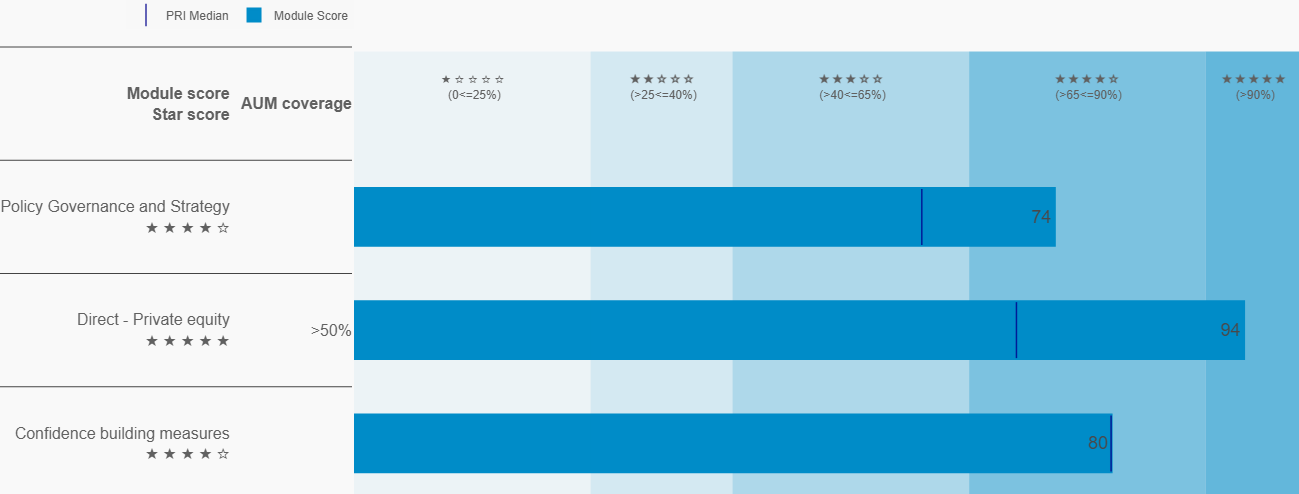

Vespa Capital is delighted to have achieved a score of 94% in the Private Equity module, gaining a five-star, top decile rating, measured against a PRI median of 74% amongst the cohort of Investment Managers in Europe with AUM of <USD$1bn. Five stars is awarded to signatories who demonstrate leading responsible investment practices amongst c.3,100 Investment Managers and c.650 Asset Owners.

Vespa Capital also attained a score of 74% in the Policy Governance and Strategy module (PRI median 64%) and a score of 80% in the Confidence Building Measures module (PRI median 80%).

“We consider ESG to be a key feature of our value creation programme and these results are another considerable endorsement of the progress that the Vespa Capital team is making across our business in the advancement of the ESG agenda.” Commented Sam Calder, Investment Director.

See link to Vespa Capital’s Full Assessment Report. Public Transparency Report 2023 is available on request.

Disclosure: Assessment Reports are the intellectual property of the PRI. Under no circumstances can this report or any of its contents be sold to third parties. Consent the must be sought before sharing with third parties. This Assessment Report does not constitute investment advice. The assessment is based on information reported directly by Vespa Capital and on the PRI’s assessment methodology. The underlying information has not been audited by the PRI or any other party acting on its behalf. While every effort has been made to produce a fair representation of performance, no representations or warranties are made as to the accuracy of the information presented, and neither the PRI or Vespa Capital accept any responsibility or liability for damage caused by use of or reliance on the information contained within any report.